Already under pressure from Covid-19 outbreaks, congestion and labour supply issues, the Port of Los Angeles is also now suffering box shortages, according to the Container Availability Index (CAx)

Container xChange – February 2, 2021 | After struggling to cope with excess containers for much of 2020, the Port of Los Angeles on the US West Coast is now facing box shortages, according to the latest data from Container xChange.

“US container shipping supply chains have been under pressure since the summer and now the Port of LA is coping with an outbreak of Covid-19 and labour shortages. While earlier in the year the high-volume US box import port was overwhelmed with boxes, now there is a dearth,” said Dr. Johannes Schlingmeier, CEO of Container xChange, the world’s leading online platform for buying, selling and leasing shipping containers. “

A combination of global coronavirus lockdowns, blank sailings by containers lines early in the year and a surge in US consumer demand for retail imports from Asia saw boxes build up across the US during the second half of 2020. Approximately 1.5 million containers had a turnaround time of 115+ days in Q3 2020 across the US, compared to an annual average of fewer than 80 days, according to a research study published by Container xChange and FraunhoferCML.

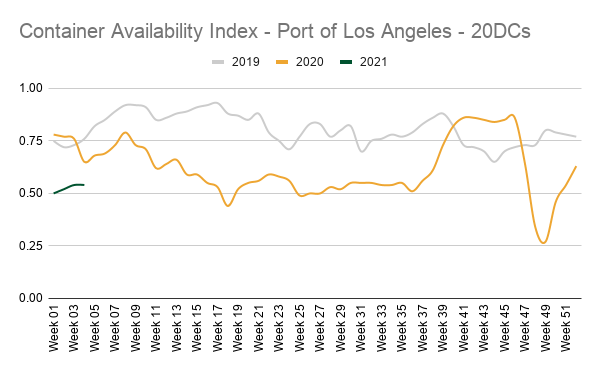

At the Port of Los Angeles, this saw Container xChange’s Container Availability Index (CAx) average 0.64 across 2020 – an index of 0.5 on CAx indicates a surplus of containers while below 0.5 indicates a shortage.

The excess of boxes was particularly acute from week 37 to week 45 (see graph below). For 20DCs (20ft. Dry Containers) the index soared to 0.86 in week 42 and, for 40DCs, reached 0.91 – a plus of 25% and 42%, respectively, compared to the 2020 average.

Container Availability Index in 2019-2021 for 20DCs at the Port of Los Angeles An index of 0.5 describes a balanced market, below 0.5 a shortage of containers

However, as lines have rushed to move empties back to Asia, the picture has dramatically reversed at the port, a leading gateway for the trans-Pacific container trade.

“Surprisingly this has created a deficit of containers in Los Angeles,” according to Florian Frese, Marketing Lead at Container xChange. “Container Availability Index values plummeted to only 0.27 for 20DCs and 0.29 for 40DCs in week 49, 2020. A minus of 57% for both container types compared to the average index values for weeks 1-48.”

“We’re expecting further volatility in container availability in the coming weeks with every element of the trans-Pacific ocean freight supply chain under unprecedented pressure,” added Frese.