Container availability is dropping across Asian ports while some US and European ports suffer from increasing dwell times and port congestion. Especially the availability of 20-foot containers at the Port of Los Angeles increased by 156%, according to the Container Availability Index (CAx).

With reinstating their TP8/Orient and TP11/Elephant services, Maersk has not only lowered the number of blank sailings but also communicated supply chain threads. Maersk urged their shippers to add more buffers to supply chain schedules as there is still unexpected demand between Asia and the US.

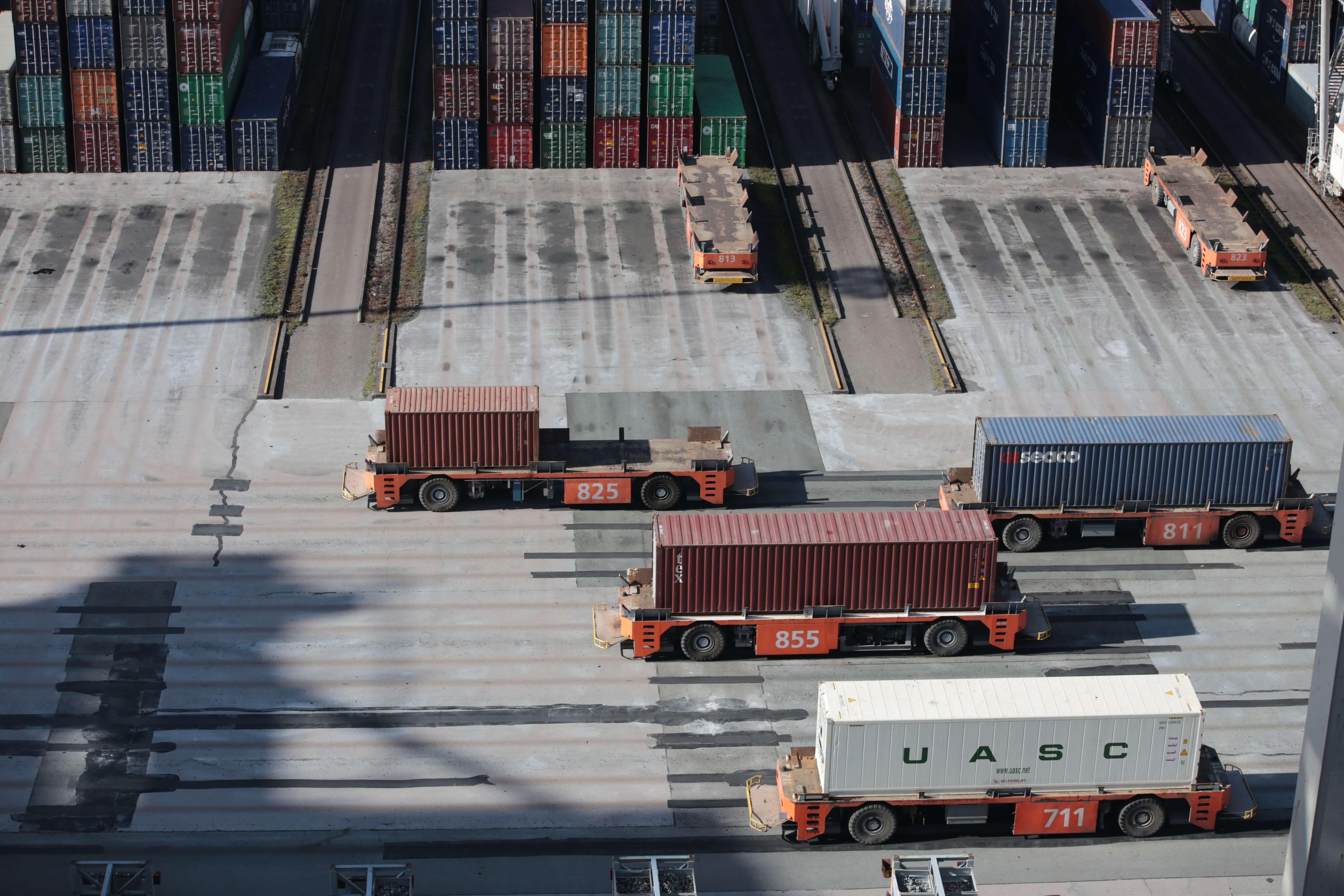

Consequently, equipment shortages across Asia and port congestion in various European and US ports increased over the last weeks. Importers in Europe and the US struggle to return empty containers to Asia, caused by the spike in imports in July and August following the reopening of their economies after weeks of lockdowns.

Now carriers are having difficulties returning the boxes to load ports in Asia. Hapag Lloyd, for example, will now only release empty containers from its mainland China depots for a maximum of eight days prior to the arrival of the sailing.

In contrast, CMA CGM will charge a $150 per TEU port congestion surcharge from Oct. 1 on all Asian containers imported or exported through Felixstowe. The UK’s busiest port struggles with operational issues and volume increases. Extra costs are difficult to pass on by the importer to the end-customer.

Additionally, Maersk highly recommends returning empty containers to free up chassisWhat is a chassis? Chassis, in freight & logistics, refers to a skeleton framework with wheels on it used to move containers. It is also called intermodal chassis or container chassis. Similar to ... More and improve operational velocity in terminals at the Port of Los Angeles. This development makes forecasting and gaining transparency extremely difficult for most stakeholders as things can change overnight.

Low container availability across Chinese ports

The Container Availability Index (CAx) takes millions of data points from transactions on xChange and tracking data that is globally available. All these data are considered and part of the forecasts of the availability of equipment for most of the biggest port locations. CAx values of above 0.5 indicate a surplus of equipment, values of less than 0.5 indicate a deficit of containers.

If we have a look at the availability at the Port of Qingdao, we will see that the availability of 20DCs, 40DCs, and 40HCs has seen an abrupt drop since week 36. Going from a value of 0.7 to 0.35 5 weeks later in week 41 for 40 DCs, from 0.68 to 0.59 for 40HCs and from 0.66 to 0.44 for 20DCs.

Looking at the Port of Los Angeles, the availability of standard containers has been drastically increasing. As of September 30, the availability of 40DCs is 0.57, a lot higher compared to a CAx value of 0.11 in week 35. Availability of 20DCs and 40HCs at the Port of Los Angeles are increasing in a similar manner. With changes in demand and supply, prices of containers change as well. It depends on what you’re prepared to pay, say some of our Asian sources.

Used containers cost $1744 on average across China

Let’s look at accepted trading deals on Container xChange to find out how the container imbalance situation affects used-container prices. Hundreds of shipping companies use the neutral online platform to buy or sell containers online and without commission. Looking at data for used-containers in cargo-worthy conditions, manufactured between 2000 and 2005 we could identify the following trends.

The equipment situation also affects buyers and sellers of containers on Container xChange. On average, used standard containers (20DC, 40DC and 40HCs) manufactured between 2000 and 2005 cost $1744 across all Chinese ports with peaks in the last couple of weeks. With +115% in week 28, +90% in week 32, and +78% in week 35 compared to the avergae, we can see that sellers ask for higher prices due to lower container availability in Asia.

Globally, we see up and down movements in the last couple of weeks. We reached the highest prices in week 25 with $1265 per sold standard container compared to $1736 in week 31. The global average for standard equipment was $1448 per container sold between weeks 23 and 39. In the US, containers were obviously a lot cheaper at $1283 on average.

Comparing prices of containers at European Ports can save you $121.88 per container. Prices for units built between 2000 and 2005 cost $1262 on average in Rotterdam, $1337 in Antwerp and $1384 in Hamburg. Unsurprisingly, 20DCs are cheapest at $1060 on average in all three locations, followed by $1322 for 40DCs and $1654 for 40HCs.

Container shortage in Asia not disappearing any time soon

Most people we talked to don’t see container shortages in Asia disappearing anytime soon. Strong demand in the US for e-commerce merchandise and medical supplies, such as personal protective equipment, will last into October, and probably beyond that. Carriers are now cutting back on additional free days of usually 20 days or more for large retailers while keeping the free storage time of 3 days.

This is one of the reasons why demand for containers across Asia on xChange increased to record levels. Finding containers for one-way use, if possible, helps increase flexibility, avoid demurrage & detention and remain under control in times of extensive surcharges. On the neutral one-way platforms, users can still find containers ex China to most of the biggest US ports such as Jacksonville, Houston, Oakland, or Denver.

Feel free to get in touch if you have cargo ex China or any other location into 2500 ports globally. Just click on the banner below to use the free public search and find available containers. 400+ shipping companies are already using xChange to buy, sell or lease containers, what’s holding you back?