Container damage replacement value is a term linked to container insurance. We know the importance of protecting your box against things like irreparable damage or being lost at sea. Read on to understand more about what this particular term means, and how you can navigate it.

The shipping industry has shaped the import and export world in many ways, but with reward, there’s always a risk. Moving your containers across long distances is tricky at times, which is why it’s vital to be as prepared as possible. Container damage is a costly affair and is something you want to avoid as best as possible.

In order to be prepared, you’ll need to understand a few important terms. Let’s begin with container damage replacement value:

Multicolor shipping containers stacked high at a port.

Container damage replacement value: Explained

Container damage replacement value can be broken up into two sections for a better understanding:

Replacement value – You’ve most likely heard of replacement value while talking about insurance. This term simply means that you’ll receive full coverage for any damages to your container whether it be in the form of a cashback or replacement of the container itself.

Container damage – You might think that your box is sturdy and strong, but even the strongest containers face damage against the rough seas. Unpredictable weather conditions, bad stowing, and mishandling during the loading and unloading process are some reasons your box might return with a few bumps or scratches.

In essence, container damage replacement value protects the container user from paying for a total loss of the container or unrectifiable damage.

Container damage replacement value vs discounted residual value

If you know your way around the industry, then you’ve already heard of the term ‘discounted residual value’. However, if you’re still unfamiliar, let’s discuss what it means and how it can be linked to container damage replacement value.

You already know what container damage replacement value is and what it means, so let’s focus on discounted residual value (DRV) here.

The DRV is an agreement between the user and the supplier that states the current value of the container itself. Both users and suppliers must agree on this amount when they first enter this agreement.

There are three main parameters for discounted residual value:

| Newbuild price | Price of newly built containers or those in the process of being built |

| Depreciation per year | The percentage which determines how the container value decreases per year due to factors such as wear and tear and longevity. |

| Minimum replacement | The minimum cost determined to replace the container |

The main objective of this type of agreement is to offer security to suppliers to ensure that if the user doesn’t return the leased containers within the time period agreed upon, the supplier is still compensated. In simple words, it secures the deal.

Both container damage replacement value and discounted residual value act as insurance agreements, the only difference here is that replacement value works for the user and residual value for the supplier. They are equally as important and support:

- Mitigation of financial risk

- Security and protection

- Cost saving

- Peace-of-mind

Now you know more about discounted residual value, how about we look at more types of container value:

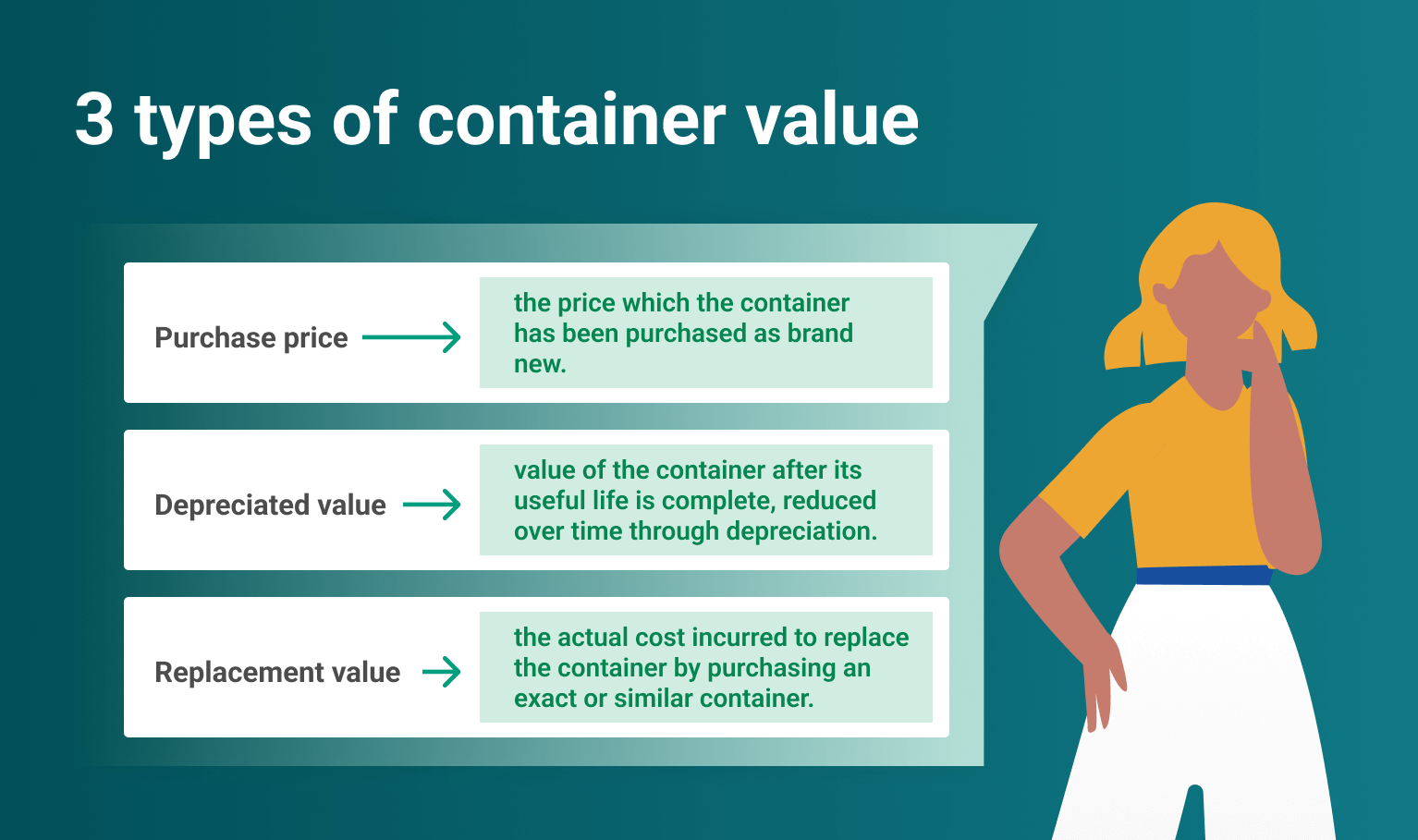

3 types of container value

Containers are either owned or leased and operated by multiple companies in the shipping industry. The average adjuster will seek data on the value of the containers stowed on board the vessel, as well as suitable security for their release.

There are different types of container value linked to insurance, so let’s have a look at the three most common types:

| Purchase price | The cost of purchasing the container as brand new |

| Depreciated value (DV) | Value of the container decreases after long-term usage due to factors such as wear and tear or obsolescence. |

| Replacement value (RV) | The total cost incurred to replace a container by purchasing an equivalent container from the market. |

Container damage: 4 ways you can avoid it

There are some things that you just can’t control. Unfortunately, container damage is one of those things. Physical damage to a container can happen without warning and this has a domino effect — container damage affects its condition which in turn affects the cost of the box itself. However, there are ways in which you can avoid it and protect your assets wisely.

- Arrange proper stowage

- Pre-plan your routes

- Always check weather conditions

- Arrange regular container inspection

Another way you can protect your box is through container insurance.

It’s always great to be prepared ahead of time by opting for container insurance. Think of it this way; you’ll avoid having to spend hefty amounts of cash on container repair by choosing a good insurance cover. Container insurance varies from broker to broker, so it’s good to know more than one type.

Here are some container insurance types and what they cover:

Physical loss and total loss

Physical and total loss occurs when the container is destroyed or damaged, or when you’ve completely lost the container (lost at sea). This type of insurance covers you for total damage to your box.

Recovery and maintenance costs – Full Equipment Cover (FEC)

This type of insurance offers you full coverage if your equipment or cargo is damaged in transit

Damage repair and lost units

This policy covers loss or damage to your container

Third-party liability

Protects you against any claims made by third parties for damages that you might not be responsible for

Coverage on residual value on equipment

Residual value is the estimated value of an asset at the end of its useful life, in this case, the container. This policy covers the estimated value of the equipment once it reaches the end of its lease term.

Here’s how Container xChange can help you with container damage replacement value.

Container xChange and container damage replacement value

One of the ways Container xChange helps you with container damage replacement value is through insurance. We offer two types of container insurance on our platform:

- Total loss insurance – $2.50 USD up to 4.10 USD per container

- Container damage insurance – $12 USD up to 140 USD per container

(These prices are dependent on container type and are subject to a 60-day period.)

Our container insurance covers (actual) total loss, constructive total loss, general average, and unusual disappearance, and can be added to any purchase. You can also benefit from our basic and premium insurance:

| Basic insurance | Protects the equipment in the event of a total loss, such as being lost at sea, mysteriously disappearing, or serious damage that cannot be repaired. Valid for one-way moves up to 60 days from pickup day and renews automatically. |

| Premium insurance | Covers any physical damage to your container including a total loss. Valid for one-way moves up to 60 days from pickup and renews on a day-to-day basis. |

When referring to container damage replacement value, it’s best to opt for total loss insurance here as we will cover the complete loss or damage of your container. These features directly link to Container Control, our new product that helps you keep up with all your container operations.

Simplify the hassle of container damage replacement value with Container Control

It’s a tedious process to have to constantly jump between different sites to find reliable insurance cover. This coupled with having to keep track of your container operations may be frustrating. Using old, outdated methods, like excel spreadsheets, can only add to that frustration.

But with Container Control, you don’t want to have to wonder about the status of your box while trying to find suitable coverage all at once.

Container Control makes your daily logistics operations much more efficient and gives you better control of your business. It also provides a comprehensive overview of all the containers you’re transporting. So, you can say goodbye to outdated resources and say hello to digitization. And all of this under one online platform!

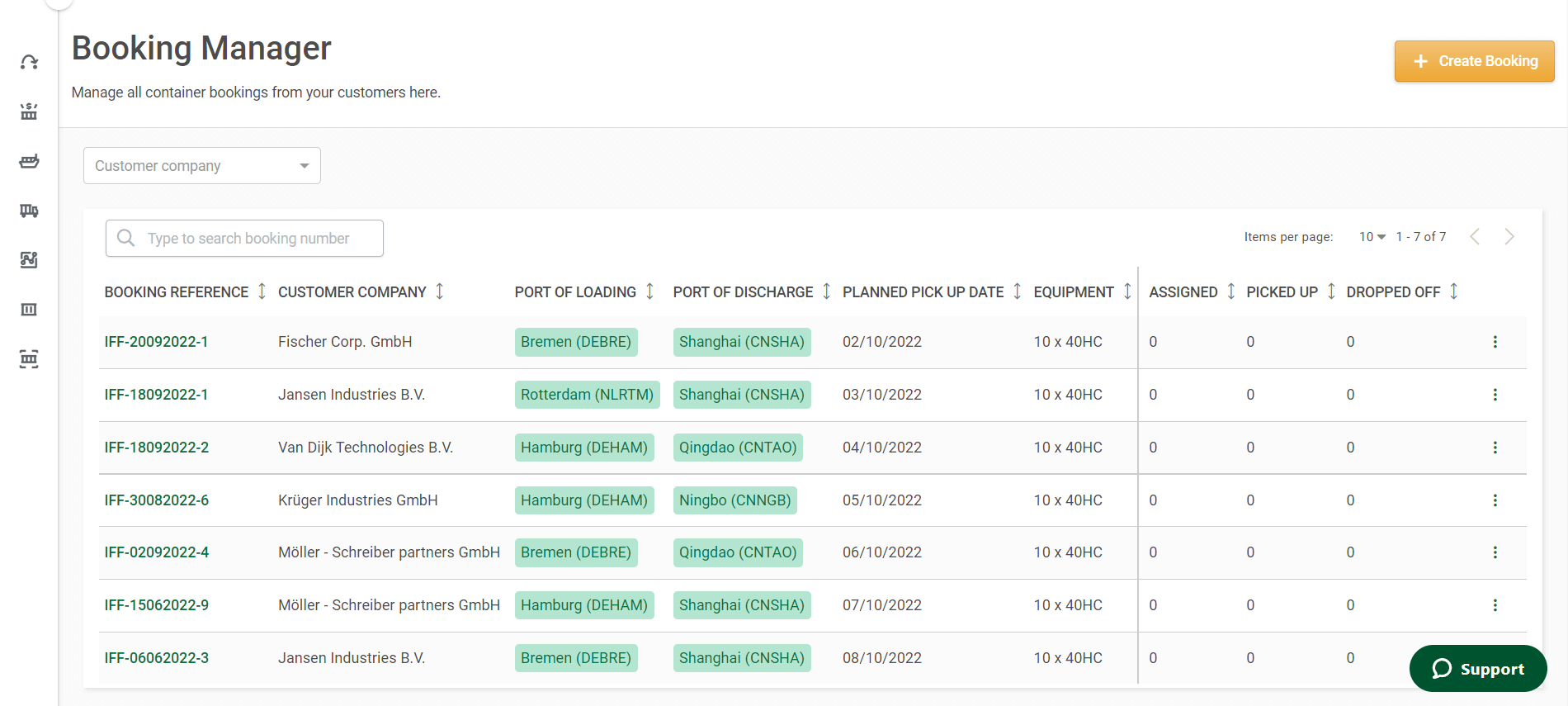

Container control has two main features:

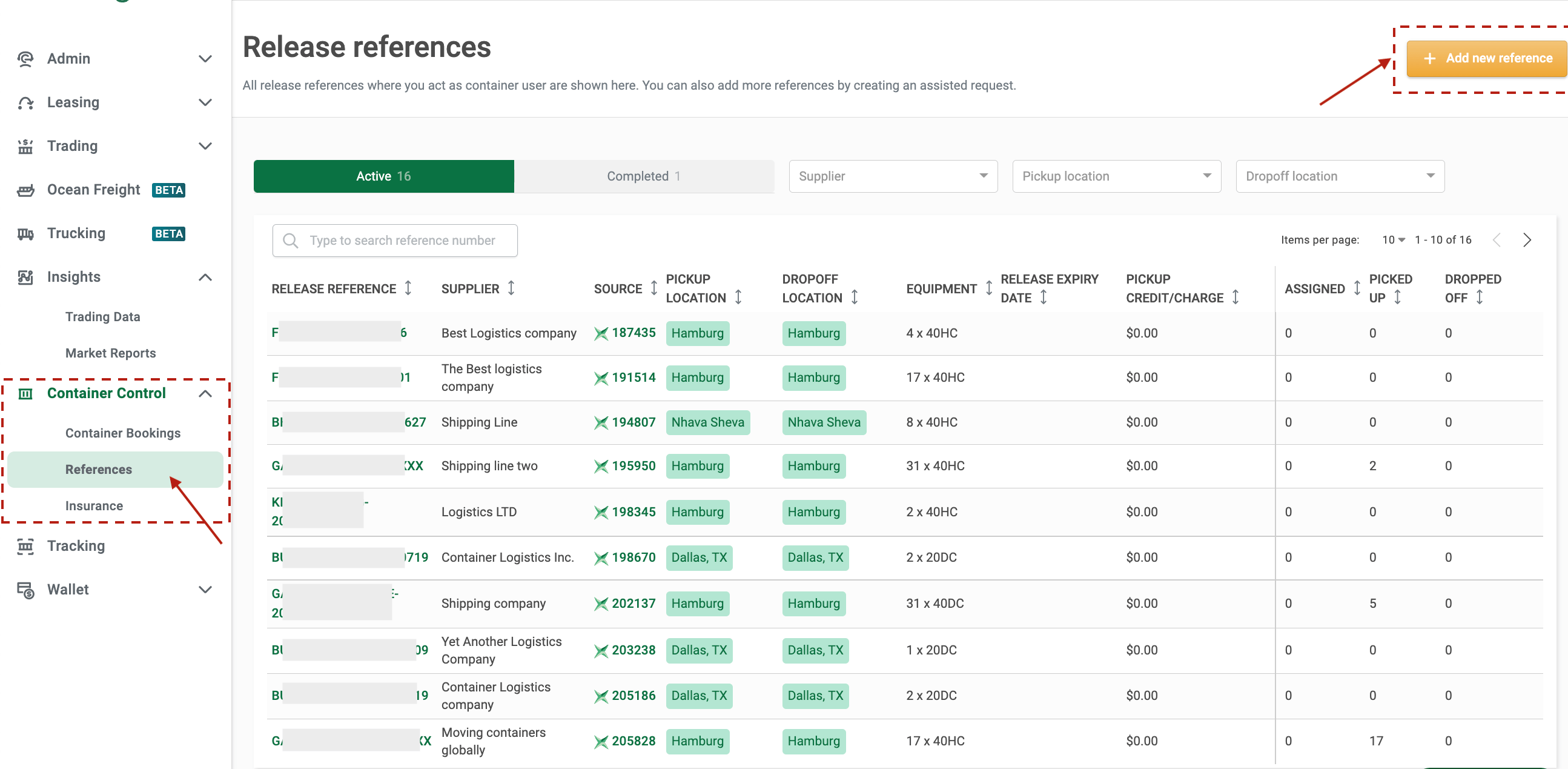

Release Reference

With release reference you can:

|

Manage bookings with the Booking Manager

Manage bookings with the Booking Manager

With the booking manager, you can:

With the booking manager, you can:

|

Container control also helps with container surveying, insurance, and repair. Now you can focus your time and energy on other business matters while we handle the rest for you!

Sounds interesting? Then click on the banner below to find out more, and we’ll connect you to one of our experts who’ll be happy to help answer all your queries. 👇

Container damage replacement value: FAQs

What is container damage?

Container damage refers to damages caused to the container due to improper stowage, unpredictable weather, theft, accidents, contamination, and mishandling.

What is a damage replacement value?

Damage replacement value is a type of insurance that covers the container user when faced with a total and complete loss, or if the container is considered a write-off.

Why is container damage replacement value important?

Container damage replacement value is important because it helps protect your investments. Without it, you risk your container’s condition. It also mitigates financial risk and offers peace of mind.

Manage bookings with the Booking Manager

Manage bookings with the Booking Manager