Container throughput is a crucial indicator of economic growth, measuring the volume of goods that pass through ports. Read this blog to find out what aids and hinders port efficiency. Plus, lease SOCs on xChange to increase your operational flexibility and save on port charges.

As global markets continue to expand and container traffic increases, it’s important to be able to measure the efficiency of ports around the world. That’s where container throughput comes in. This key metric tells us how many containers pass through a port in a given time frame. A high number shows a high level of port efficiency – with minimal bottlenecks and container pile-ups.

Unfortunately, many external factors hinder a port’s ability to function optimally, leading to congestion and delays. And with hold-ups, come those dreaded demurrage and detention fees.

Luckily, with SOCs on Container xChange, you can say goodbye to D&D charges for good. We’re an online marketplace for leasing and trading shipping containers, with 100,000+ units available in over 2,500 locations worldwide.

On our platform, choose SOCs from 1,500+ vetted partners, and connect directly to negotiate the rates, terms and conditions. Don’t believe us? Select your pick-up and drop-off locations below to browse and compare SOC offers that fit your budget and criteria right now.

25 x 40HC

Container Supplier

Container Company Blurred Name

5

Pick-up charge

User pays

$120

19 Freedays

$44.20 Per diem

What is container throughput?

Container throughput is a measure of the number of containers that pass through a port within a given time frame. Throughput provides insights into the volume of goods being transported and traded through a particular port. It looks at the overall container traffic, including inbound, outbound, full and empty units.

Ports with high container throughput numbers are usually seen as international trading hubs.

There are three main metrics used to measure container throughput:

| TEUs (Twenty-Foot Equivalent Units) | The TEU is the standard unit of measurement in the shipping industry, based on the capacity of a standard 20ft dry container. This is used to gauge the volume of containers that can be handled by a port, system or facility. |

| Throughput capacity vs actual throughput | Throughput capacity refers to the maximum volume of containers that can be handled by a port, system or facility. Actual capacity represents the real volumes handled over a particular period. |

| Peak vs average throughput | Peak throughput is the maximum rate at which containers can be handled over a short, specified time period, usually under optimal conditions. Average throughput refers to the average rate over an extended period of time. |

Container Throughput Index

The Container Throughput Index (RWI/ISL) is an indicator of global container throughput. This index is published monthly and provides data from 90 international ports. These ports account for around 64% of the global container traffic. Check out the latest Container Throughput Index data now.

Why is container throughput data important?

Understanding the global container throughput data gives us insights into the dynamics of world trade and the economy’s overall health. High container volumes indicate a thriving economic situation, with large trade volumes and a strong demand for consumer goods.

In terms of container ports, a high container throughput number indicates a well-functioning, efficient operation, capable of handling huge volumes of cargo. When ports are able to process high cargo volumes, they become strategic hubs along global trade routes.

Besides this, throughput information is useful for businesses, who use the data to gain visibility into the supply chain industry, and track the latest traffic trends. This in turn helps them to manage production levels, predict disruptions, and make smarter decisions about the sourcing, manufacturing and distribution of their products.

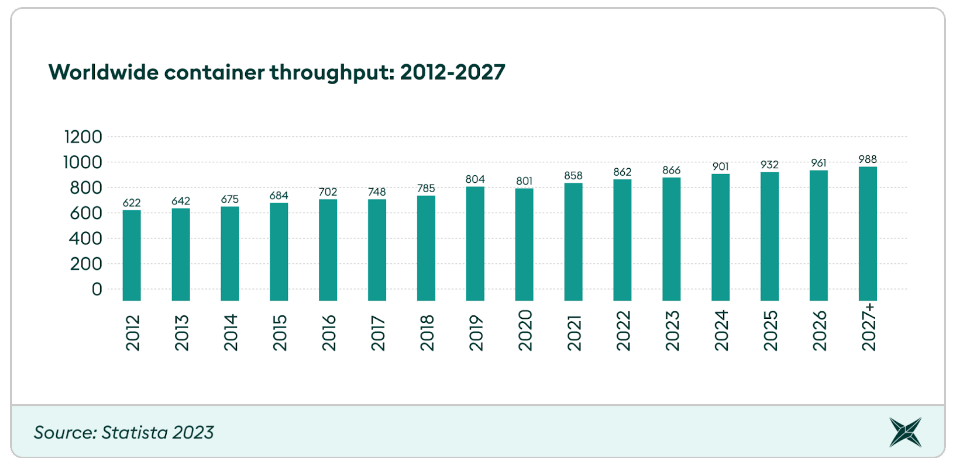

Global container throughput projections until 2027

Let’s take a look at the below graph, which indicates container throughput figures from 2012 to 2022, with predicted figures until 2027.

In 2023, worldwide throughput reached 866 million TEUs. As we can see from the graph, throughput numbers steadily increased between 2012 and 2022 (minus 2020, due to the Covid-19 pandemic). Following this trend, it’s predicted that throughput figures will continue to climb between 2023 and 2027.

Overall, this indicates that container traffic numbers likely to continue to rise over the coming years due to an increase in demand for global imports and exports. Ports are going to have to keep up by improving their processes, adopting higher levels of automation, and updating machinery and software wherever possible.

Next, we’ll look at throughput data for some major container ports around the world. From this data, you’ll see that container throughput is heavily influenced by both macro and micro-economic activities.

Shenzhen Port remains largest Chinese port by cargo volume

In 2023, Shenzhen Port maintained its spot as the busiest port in China, boasting 44.4 million TEUs between January and November. The port has shown year-on-year growth of 2.8%.

Along with this, container throughput at 12 major Chinese ports amounted to 283,8 million TEU between January and November 2023.

Jawaharlal Nehru keeps spot as top-performing port in India

Jawaharlal Nehru is one of the biggest ports in India, handling over 50% of all container traffic passing through the country. In 2023, Jawaharlal handled 6.4 million TEUs, a 6.63% increase from the previous year.

Delays cause sharp drop in container traffic at Los Angeles Port

The Port of Los Angeles has claimed the title of busiest port in the US for the last 22 years, moving approximately 10 million containers each year. Unfortunately, in 2023, this port faced a lot of delays and congestion, resulting in lower-than-usual container throughput. In 2023, Los Angeles port experienced a 26.85% decrease in volume.

Geopolitical tensions reflected in Antwerp-Bruges container throughput data

The Port of Antwerp-Bruges, Europe’s largest integrated chemical cluster faced a challenging year in 2023. Geopolitical tensions atop a decline in economic growth meant container throughput was down 5.5% at 271 million tons.

Now that we’ve seen some container throughput data from 2023, let’s learn more about what influences container traffic volumes in general.

3 factors that influence container port throughput

Container traffic is affected by various economic factors such as:

- Global trade patterns

- Economic trends

- Logistics efficiency

- The infrastructure and capacity of the port itself

- Geopolitical tensions, wars, and recessions

Let’s take a look at the 3 main factors below:

Port infrastructure: Container throughput is directly affected by port infrastructure. If a port’s machinery and equipment are old and outdated, it’s unlikely to be able to handle high cargo volumes. Ports with sophisticated infrastructure and advanced systems are more likely to process large cargo volumes successfully.

Technological advancements: Advancements like automation and the use of blockchain technology help to streamline port operations. This in turn allows for higher container traffic at ports and thus higher container throughput numbers.

Port regulations: Regulations differ from one port to another. If regulatory requirements are particularly complicated and time-consuming, this may hinder the flow of cargo into and out of a port, causing delays and hold-ups. Ports with efficient and streamlined regulatory processes are likely to have higher throughput numbers.

Global container throughput: Challenges

Now we know what influences container throughput figures, but what about the challenges? Let’s take a look:

Port congestion: Port congestion poses a serious challenge to the efficient flow of cargo.

It means delayed berthing for many ships and has a knock-on effect on the rest of the shipping process. Port congestion often leads to lower container throughput, as backlogs and container pile-ups take place, and the port is unable to keep up with the flow of cargo.

This leaves shippers unsure when their cargo will be delivered, as well as racking up demurrage and detention fees. Sadly, port congestion is not within our control. However, by leasing SOC containers on the xChange platform, it’s finally possible to avoid demurrage and detention charges. We’ll explain more in the next section.

Container imbalances: Container imbalances occur when there is surplus of containers at one port and a deficit in another. In a region or port with a container deficient, there may not be enough units to transport all of the cargo that needs shipping.

This means longer turnaround times as port operators and shipping lines work to reposition containers. Moving empty containers is not only wasteful but also expensive.

Want to avoid empty container repositioning? Connect with partners on our leasing platform and get paid to reposition your units. It’s a win-win!

Now, let’s learn more about how you can work around port charges and avoid empty container repositioning with SOCs on Container xChange.

Increase flexibility and save money with SOCs on Container xChange

With container traffic volumes predicted to continue climbing in the coming years, it’s important to make smart, strategic decisions for your business. Luckily, leasing SOCs on Container xChange will solve a host of problems in one.

Once you’re a member, it’s quick and easy to source the containers you need, anytime, from anywhere. Here are the 3 main benefits of using SOCs:

Source your own containers: You’re able to source your own containers. This is especially important when shipping to locations where carriers are unable or unwilling to provide units, or only offer them at very high rates. Instead, you bring your own units, and book slots for them on a vessel.

Control your terms: You’re able to select the exact containers you like, in a condition you’re comfortable with. You also get to decide how long to keep the containers for. On xChange, negotiate the leasing rates, free days and per diem charges directly with the supplier – no middleman involved.

Keep costs down: By bringing your own units, you avoid demurrage and detention charges, as you won’t be obligated to return your containers within a specified time frame. This is especially important in areas with container surpluses, where port congestion and container pile-ups mean your units could be sitting around for some time, racking up fines.

Ready to save cash and avoid nasty port charges piling up? Then get started with a free demo of the xChange leasing platform. You’ll learn how to source SOCs quickly and easily, at rates that suit you. Click below to set up your platform tour today.

Container throughput: Common FAQs

What is container throughput?

Container throughput measures the number of containers that pass through a port in a certain time period. Throughput measures the overall container traffic, including inbound, outbound, full and empty units.

How do you calculate container throughput?

You can calculate container throughput as follows: Throughput (TEU) / 8760 hours x peak factor (assumed 2.5) / TEU factor (assumed 1.5). This gives you the peak waterside requirement in containers per hour.

What is the container throughput index?

The container throughput index (RWI/ISL) is an indicator of global container traffic. This index incorporates data collected from the ISL Monthly Container Port Monitor. The index uses data from 94 international ports on an ongoing basis.